CASE STUDY

DEFINED BENEFIT OCIO SEARCH

Background

North Pier was engaged to assist a hospitality company that acquired a property with a $17 million existing frozen defined benefit plan. Benchmarks revealed that the portfolio was under-performing, and the traditional advisor’s fees were above market. The plan sponsor’s investment committee had little to no experience with making investment decisions for DB plans and wanted to investigate ERISA §3(38) OCIO management as a means to mitigate liability.

Challenges

- Source high quality OCIO managers with experience and willingness to accept an OCIO mandate below $20 million

- Find an OCIO that demonstrated excellence working with frozen DB plans

- Find an OCIO manager that could gain the trust of the investment committee easing the transition to OCIO

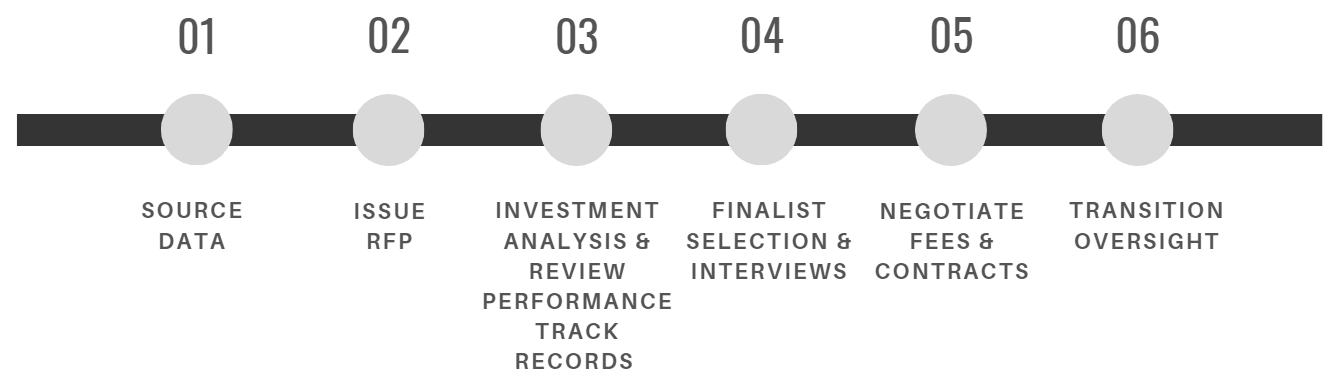

Process

- Sourced data and administered a Request for

Information from over 40 qualified investment

managers

- Administered an RFP and performed detailed

due diligence

- Reviewed performance track records and

performed in-depth investment analysis on six

top-notch OCIO candidates

- Assisted in the selection of three finalists;

moderated, organized, and coordinated the

finalist presentations and selection conference

- Negotiated and reviewed fees and contracts

- Provided oversight during asset transition

Outcome

The OCIO Search found the best candidate with DB expertise to provide, fiduciary relief & reduced investment fees by over 50%.

- Committee selected an OCIO manager and

was able to comfortably transition investment

responsibilities

- Transitioning to an OCIO resulted in the plan

reducing investment fees by over 50% compared

to their traditional advisor model

- The transition to the new OCIO fund manager

was accomplished without a hitch